The term Vaporware came about in the 1980s and has been used to criticise companies that overhype products without following through on development. Tech giants like Microsoft, Apple, and Oracle have all been accused of creating vaporware but this has hardly impacted their revenue or customer retention. From wikipedia:

The first reported use of the word was in 1982 by an engineer at the computer software company Microsoft.[6] Ann Winblad, president of Open Systems Accounting Software, wanted to know if Microsoft planned to stop developing its Xenix operating system as some of Open System's products depended on it. She asked two Microsoft software engineers, John Ulett and Mark Ursino, who confirmed that development of Xenix had stopped. "One of them told me, 'Basically, it's vaporware'," she later said. Winblad compared the word to the idea of "selling smoke", implying Microsoft was selling a product it would soon not support.[3]

Fast forward to the mid-2010s, the Theranos scandal (read more here and 2015 WSJ article) showcased the dangerous extremes of this “fake it till you make it” mentality. Theranos, under the leadership of Elizabeth Holmes, claimed it could revolutionise blood testing with a device requiring only a drop of blood to perform hundreds of tests. The promises captivated investors and the public, but the technology never worked as advertised. Holmes was later convicted of fraud, highlighting the severe risks and potential harm when hype overshadows reality, especially in healthcare.

Despite the Theranos scandal, the tech industry continues to grapple with overselling. Several more scandals have emerged since Theranos, though none garnered the same public and media attention. Take Babylon Health, for example. Despite lacking the promised AI (a symptom checker that could diagnose and treat common illnesses), Babylon secured lucrative contracts and partnerships, leading to a high valuation. However, the company’s spending couldn’t keep pace with its losses, and its stock price plummeted. After a failed rescue attempt, Babylon filed for bankruptcy in both the US and UK (2023).

Then there was also Outcome Health from Chicago, whose business involved installing ad-supported patient information and consent touchscreens in doctors’ offices and waiting rooms. The company was later (in 2023) accused of mail fraud, wire fraud, bank fraud, and money laundering. Fun stuff!

According to an April 2023 article in The New York Times titled “The End of Faking It in Silicon Valley,” funding for high-risk startups has dwindled for a while, and several high-profile fraud cases have emerged, suggesting a shift in the industry. Notable examples include the arrest of Charlie Javice of Motive (formerly Frank), Carlos Watson of Ozy Media, Christopher Kirchner of Slync, Manish Lachwani of HeadSpin and Sam Bankman-Fried of FTX:

Faking it is over. That’s the feeling in Silicon Valley, along with some schadenfreude and a pinch of paranoia.

Not only has funding dried up for cash-burning start-ups over the last year, but now, fraud is also in the air, as investors scrutinize start-up claims more closely and a tech downturn reveals who has been taking the industry’s “fake it till you make it” ethos too far.

Take what happened in the past two weeks: Charlie Javice, the founder of the financial aid start-up Frank, was arrested, accused of falsifying customer data. A jury found Rishi Shah, a co-founder of the advertising software start-up Outcome Health, guilty of defrauding customers and investors. And a judge ordered Elizabeth Holmes, the founder who defrauded investors at her blood testing start-up Theranos, to begin an 11-year prison sentence on April 27.

Those developments follow the February arrests of Carlos Watson, the founder of Ozy Media, and Christopher Kirchner, the founder of software company Slync, both accused of defrauding investors. Still to come is the fraud trial of Manish Lachwani, a co-founder of the software start-up HeadSpin, set to begin in May, and that of Sam Bankman-Fried, the founder of the cryptocurrency exchange FTX, who faces 13 fraud charges later this year.

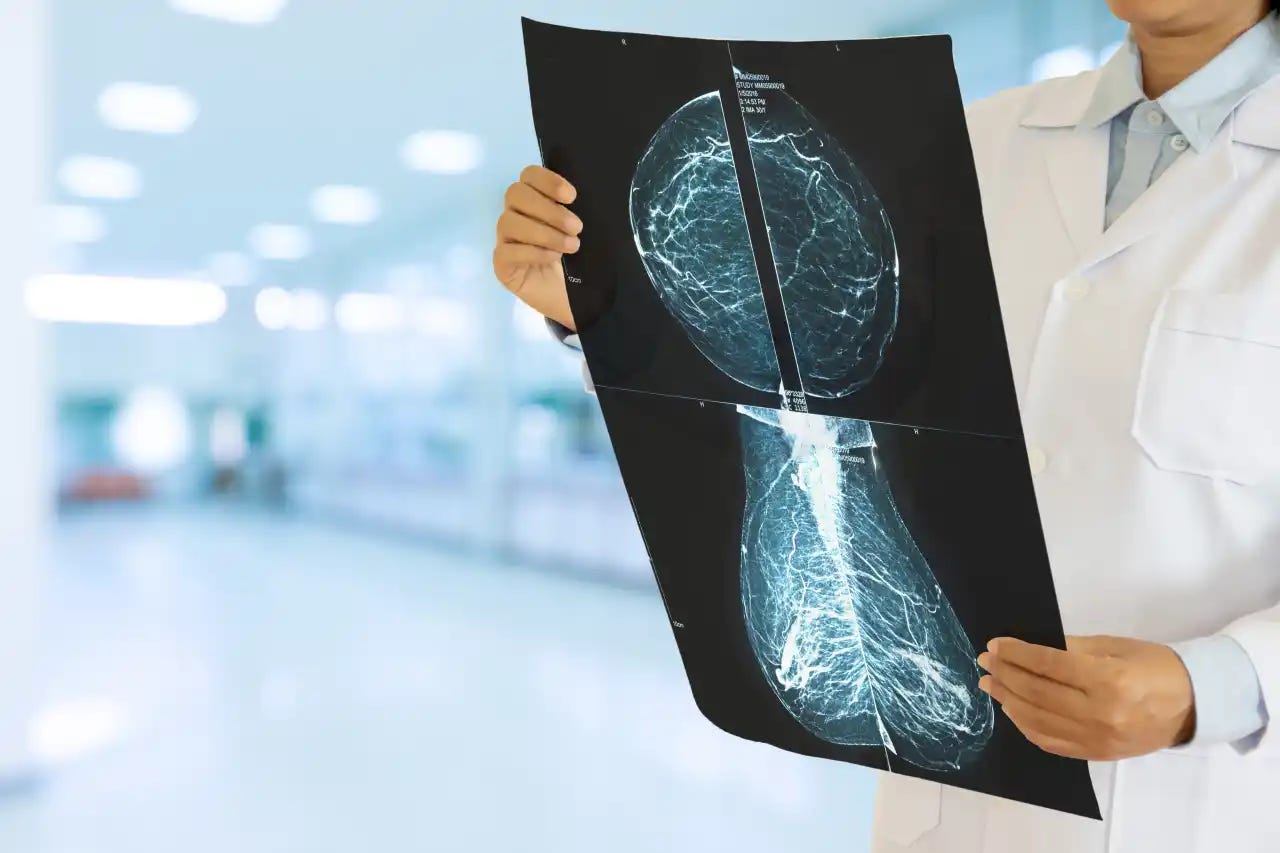

But this slowdown was just temporary. Despite all these scandals, the appeal of innovation and the prevailing “fake it till you make it” mentality indicate that faking it is far from over. Our recent AI/LLM hype is a case in point. Remember Geoffrey Hinton’s prediction in 2016 that AI would replace radiologists by now? It seems the opposite is happening. AI tools add extra work for radiologists who still need to analyse everything, and can even lead to errors due to over-reliance. Additionally, AI bias and growing caseloads create more complexity and risk, making AI a burden rather than a benefit for radiologists.

As long as there’s pressure to deliver quick breakthroughs and investors seek rapid returns, the tech industry will continue to struggle with balancing hype and reality. This pressure can lead to cutting corners, potentially resulting in fraud and deception. Despite the Theranos debacle, a recent example is the rise of Toronto-based Vital Biosciences. Their desktop blood-testing solution bears a worryingly similar promise to Theranos’ technology. Vital has already secured $48 million in funding from prominent investors, including OpenAI CEO Sam Altman and Salesforce CEO Marc Benioff, indicating that the allure of groundbreaking innovation can still outweigh caution. Vital claims its device can process over 50 lab-grade results from a sample larger than a pinprick but much smaller than traditional blood draws, using advanced technologies like microfluids and computer vision.

Of course, the next big scandal probably won’t be a carbon copy of Theranos. OpenAI has a product that works. But Sam Altman's investment entanglements and vision (like his ambitious plan to invest in 7 trillion dollar AI chips to restructure the entire semiconductor industry) could raise concerns. Silicon Valley still boasts creativity and perseverance when it comes to vaporware so let’s wait and see. But whispers in the interwebs have emerged asking: Is OpenAI the next Theranos? There’s big hype, check. Big names on the board and lots of admirers, check, a leader with a Steve Jobs-esque tendencies, media attention, and of course, big money. Check and Check.

More here from Ed Zitron:

I'll cut to the chase: it's time to stop listening to anything that Sam Altman has to say. Sam Altman is full of shit, and his reign at OpenAI has been defined far more by its empty promises than any realized dreams. It's time to actively push back on Altman when he says that GPT-5 will be "similar to a virtual brain," or a "super smart person who knows absolutely everything about your life," or a "super-competent colleague," or that it'll "replace 95% of marketing tasks," or that it'll "evolve in uncomfortable ways" rather than get twisted by a group of people that know enough or give enough of a shit to make sure they're not causing said evolution.

And healthcare isn’t the only area to watch. The legal technical field, also known as legal tech, has been slowly but surely adopting AI, even before OpenAI emerged. Bob Ambrogi, a lawyer and journalist who writes the award-winning LawSites blog, recently provided a good overview of Harvey, a new AI venture backed by OpenAI. From LawSites:

It has been a whirlwind year for the Open AI-backed, generative AI legal tech startup Harvey, which went from a $5 million seed round in November 2022 to a $21 million Series A in April 2023 to an $80 million Series B in December 2023 at a valuation of $715 million.

It was a year that included some big wins, including the decision in February 2023 by Allen & Overy, one of the world’s largest law firms, to integrate Harvey into its global practice, where it could be used by the firm’s more than 3,500 lawyers across 43 offices operating in multiple languages.

…

But even with such dramatic traction for a company that is still less than two years old, there has remained an air of mystery around Harvey. The product continues to be in an early-access phase; few, other than select early-access customers, have seen the Harvey product; and the company’s founders, Winston Weinberg, its CEO, and Gabriel Pereyra, its president, have given few media interviews.

But that is about to change, the two founders told me in an interview earlier this week. They will be coming out of the early-access phase during the third quarter of the year and launching versions that they say will be more affordable to firms of various sizes, depending on their needs.

They also say that they will be showing the product more often, attending more industry conferences, and speaking more often with the press.

If you followed the Theranos saga, this all sounds eerily familiar. OpenAI-backed Harvey has experienced significant growth in a rapid rise reminiscent of Theranos. They’ve gone from a $5 million seed round in November 2022 to an $80 million Series B just a year later. There’s a shroud of mystery surrounding the product, limited public access and, the founders have granted few media interviews.

Why Do We Keep Falling for this? Read my previous take on this.

Why Do We Always Fall for Snake Oil Salesmen?

Dear Readers, welcome to another edition of the S.A.D newsletter — an exploration of our software, algorithms, and the data-driven world that surrounds us. Today we talk about science and pseudoscience. Picture this: a middle-aged, white, muscular, tattooed professor from California exuding a surfer ethos, passionately discussing science and wellness on…

Several factors contribute to this recurring issue of overselling in tech. The historical context of the “wild west” gold rush mentality in American business plays a role, encouraging a culture of risk-taking and bold promises. Additionally, the financialisation and service-oriented nature of the modern economy incentivise rapid growth and innovation, often at the expense of due diligence and regulatory oversight.

Moreover, the tech industry’s fast-paced environment and the pressure to be first to market can lead to cutting corners and overstating progress. Investors and consumers, eager to be part of the next big thing, often fall into the trap of believing the hype without sufficient skepticism.