Excerpt from Edwin Starr’s Motown hit War:

War...huh...yeah

What is it good for?

Absolutely nothingUh ha haa ha

War...huh...yeah

What is it good for?

Absolutely nothing...say it again y'allWar..huh...look out...

What is it good for?

Absolutely nothing...listen to me ohhhh

Yes, war is “absolutely good for nothing”. But this is probably just for you and me. In the words of the late Palestinian Poet Mahmoud Darwish:

The war will end

The leaders will shake hands

The old woman will keep waiting

for her martyred son.That girl will wait for her beloved husband

and those children will wait

for their heroic father

I don't know who sold our homeland

but I know who paid the price.

The bottom line is war is good for business. Let’s look at the systems and structures behind these wars. Banks. Yes, the boring banks. With all the attention given to digital currency and bitcoins, the good old banks are often forgotten. If we look at the history of various central banks, there is always a connection to financing wars (Bank of England is a prime example).

What Banks enable is not just a container of wealth but also transactions. And this is where Swift comes in (no, not Taylor Swift). SWIFT: The Society for Worldwide Interbank Financial Telecommunication, “is a Belgian cooperative society providing services related to the execution of financial transactions and payments between banks worldwide.” Due to the Russian invasion of Ukraine, SWIFT has been in the news lately (BBC, The Guardian, NPR).

The SWIFT system does not perform the actual fund transfer. You can think of it as a messaging or brokering system that enables a network of financial institutions to exchange funds. You can compare this protocol to an email or messaging protocol. Even though SWIFT is not a bank, it is tied to the nerve centre of the global banking industry.

This is a very nice illustration of how this system works:

Of course, to finance a war, it is not enough to do a transaction with your cousin (unless your cousin is Putin!). Large banks and cross-border transactions are crucial for such transactions. Right after the second world war, the global banking infrastructures realised the limitation of the telex messaging system (which was the dominant form for banking transaction system before SWIFT). The increase in cross-border trade financialisation of the economy around the 1970s prompted the creation of SWIFT. Even some of the banks involved were competitors or adversaries they needed to create an interoperable system. And more and more international payment infrastructures have become crucial for the global economy.

This is where “datafication” of money comes in. However, along with the advantage of interoperability, also comes certain privileges. Not all the banks of the world are part of the SWIFT network. One of the first bank accounts I had was at Main Street Bank in Champaign, Illinois. It did not have a SWIFT account. I think there are still small banks in the United States without SWIFT accounts.

Along with datafication and interoperability, you also get control. This is where the modern ideas of sanction work. In fact, SWIFT sanctions or restrictions for Russia is nothing new. European Parliament passed a resolution on 29 April 2021 on Russia regarding Alexei Navalny, then military build-up on Ukraine's border and Russian attacks in the Czech Republic:

Underscores that if such a military build-up were in the future to be transformed into an invasion of Ukraine by the Russian Federation, the EU must make clear that the price for such a violation of international law and norms would be severe; insists, therefore, that in such circumstances imports of oil and gas from Russia to the EU be immediately stopped, while Russia should be excluded from the SWIFT payment system, and all assets in the EU of oligarchs close to the Russian authorities and their families in the EU need to be frozen and their visas cancelled;

Yes, this was 2021. And then also on 16 Dec, 2021:

Underscores that the new package of sanctions should include the Russian officer corps and flag officers involved in the planning of a possible invasion, and the immediate circle and oligarchs in the orbit of the Russian President and their families; demands that such sanctions entail the freezing of financial and physical assets in the EU, travel bans and the exclusion of Russia from the SWIFT payment system, thereby excluding Russian companies from the international financial market and prohibiting the purchase of Russian sovereign debt on the primary and secondary markets, and that they target important sectors of the Russian economy and disrupt the financing of intelligence services and the military;

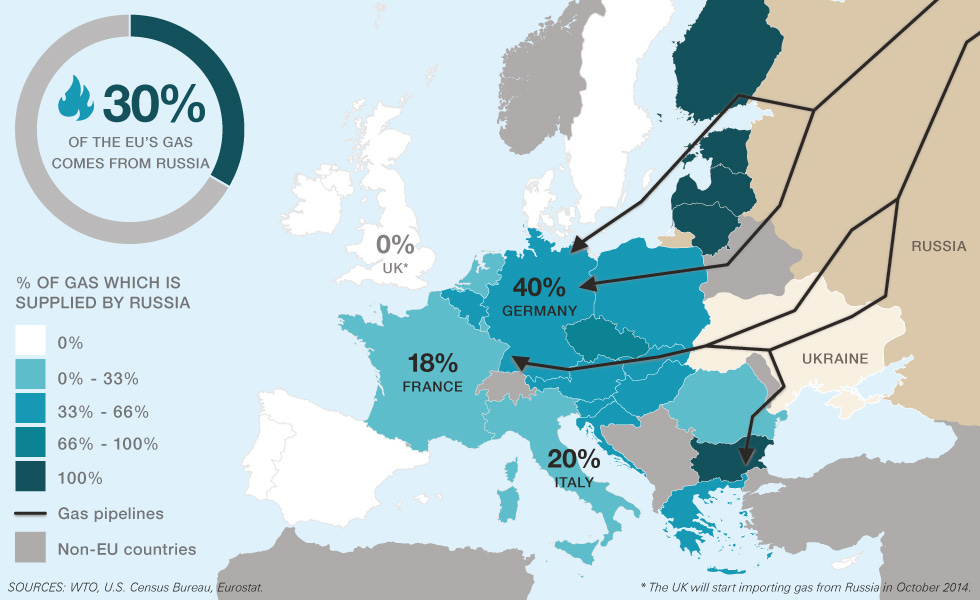

Who knows what will be the impact this time. It seems EU’s power is mostly limited to “underscoring”. And there are also rumours that Russia can use cryptocurrency. There is also Russian and Chinese SWIFT like payment networks. This sanction, if imposed, will have some impact. At the same time, due to dependence on Russian oil, the price of energy will trump humanitarian causes.

Yes, this sounds like gulf war 2003. It is always about the oil. It does not matter how datafied the transactions are the crude, slimy objects are always one barrel away.

Now back to SWIFT. Even though SWIFT is a cooperative, European Union and the U.S have some privileges. In certain cases, the U.S government can get unrestricted access to all international cross-border transactions. Some of these privileges are open, some are secret. For example, the “Terrorist Finance Tracking Program” scandal:

The Terrorist Finance Tracking Program (TFTP) is a United States government program to access financial transactions on the international SWIFT network that was revealed by The New York Times, The Wall Street Journal and The Los Angeles Times in June 2006. It was part of the Bush administration's War on Terrorism. After the covert action was disclosed, the so-called SWIFT Agreement was negotiated between the United States and the European Union.

The TTFP SWIFT scandal also caused tensions between the EU and the U.S (regarding data privacy and sovereignty). Some accused SWIFT as the vehicle of new digital colonialism and surveillance capitalism (in 2018 SWIFT hired a former Google executive as the new Head of Data Analytics).

Now, I truly hope this war and invasion ends soon. I truly hope the sanction works even though history tells us there are ways to circumvent sanctions. Let’s not forget about the power of Banks during wars. They are not the ones paying the price, we are.

Further reading:

Amsterdam Wisselbank: Amsterdam’s “exchange bank” was instituted in 1609 to provide monetary exchange at established rates, but it soon became a deposit bank for the safe settling of accounts.

Scott, S.V. and Zachariadis, M., 2012. Origins and development of SWIFT, 1973–2009. Business History, 54(3), pp.462-482. https://doi.org/10.1080/00076791.2011.638502

Not all banks are bad. Read about Dutch banker Walraven van Hall and his brother Gijs van Hall — Bankier van het Verzet or the Resistance Banker committed the biggest banking fraud during WWII, taking millions of Guilders out of the Dutch Central Bank and using the money to finance the Resistance.

Ripple: An open source payment protocol.

Shout out to one of my favourite newsletters, TSwiftEliot: “putting Taylor Swift and TS Eliot in conversation with each other”.